Prime Minister Loan Scheme 2022 - How To Apply Interest Free Loan

Welcome to The Fasaadi, Today's Prime Minister Loan Scheme 2022 blog will provide information on how to get interest free loan from Kamyab Pakistan Program. How to apply for interest free loan through kamyab program, what are the requirements for getting interest free loan in Kamyab Pakistan program and how much loan you can get through Kamyab Pakistan Program, All the information will be given to you according to the official website of Kamyab Pakistan program.

|

Prime Minister Loan Scheme 2022 - Loan Without Interest In Pakistan |

Prime Minister Loan Scheme 2022 - Government Interest Free Loans In Pakistan

For the first time in the history of Pakistan, a program of 1400 billion is being launched with the main objective of strengthening the 3.7 million families of Pakistan economically.

The Government of Pakistan has announced five programs

1: Kmyab Karobar

2: Kamyab Kissan

3: Naya Pakistan Low-Cost Housing

4: Kamyab Hunarmand

5: Sehatmand Pakistan

555

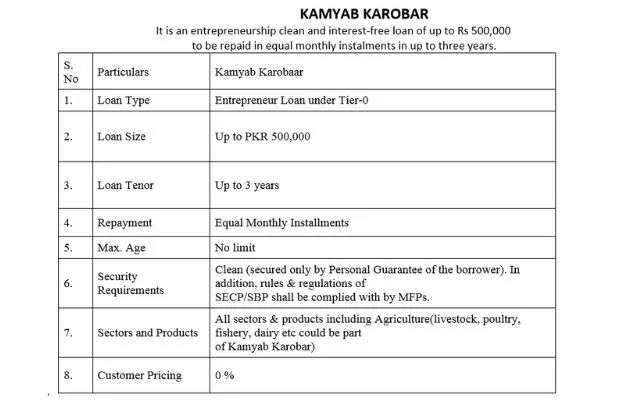

This blog will tell you the details of Kamyab Karobar Interest Free Loan:

|

| Information form of Prime Minister Loan Scheme Kamyab Karobar |

Readmore > EhsaasKafalat Program Nadra Registration

The information contained in this form is explained below

1: Long Type:

The government of Pakistan will provide loan under Entrepreneur Loan under Tier-0.

2: Loan Size:

The government of Pakistan will provide you interest free loan up to 500,000.

3: Loan Tenor:

This loan will be given to you for 3 years, which means you have to return the loan within 3 years.

4: Repayment

You can return the loan in easy monthly installments.

5: Max.Age

You must be at least 18 years old to get interest free loan in Prime Minister Loan Scheme Kamyab Karobar Program and there is no maximum age limit.

6: Security Requirements

Security Requirements means under what guarantee this loan will be given to you, this loan will be given to you on personal guarantee, this means you can get loan based on your National Identity Card and for this program, your credit history must be clear

Credit history means that if you have taken a loan from a bank, have you repaid the loan properly and you are not a defaulter of any bank or institution?

This loan will be given to you in accordance with the rules of State Bank of Pakistan security exchange commission.

7: Sectors and Products

Sectors and Products means for which sectors and products this loan will be given to you. You can get this loan for all sectors.

For example: Agree Culture Sectors or Business Sectors means you can get this loan for all businesses, in which any products like Live Stock, Fishery and Dairy etc.

8: Customer Pricing

Customer Pricing means that if you take a loan from a bank for any business, you have to pay equity in it, this equity is 10% of the loan amount but to get a loan from Kamyab Karobar Prime Minister Loan Scheme You do not have to pay any equity, mean 0% equity.

How To Apply For Interest Free Loan

Send SMS to 5771 by typing National Identity Card number from your mobile.

And then your record will be checked in the survey data. If you are eligible for this program according to this survey, you will be confirmed via SMS that you are eligible for this program and you can apply for interest free loan and via SMS will tell you where to contact to get a loan.

If you want to know more information about Interest Free Loan Prime Minister Loan Scheme, you can visit the official website of Kamyab Pakistan and click on Contact Us and get more information.(alert-warning)

Conclusion

This blog gives you complete information about Interest Free Loan Prime Minister Loan Scheme and Kamyab Karobar. If you like this information, please share it with your friends.